Driving more commerce

Carat is an omnichannel ecosystem that enables the world's best brands to drive commerce anywhere.

See Carat

Powering financial services innovation

Stay in step with consumers through digital experiences that help them understand and manage their money.

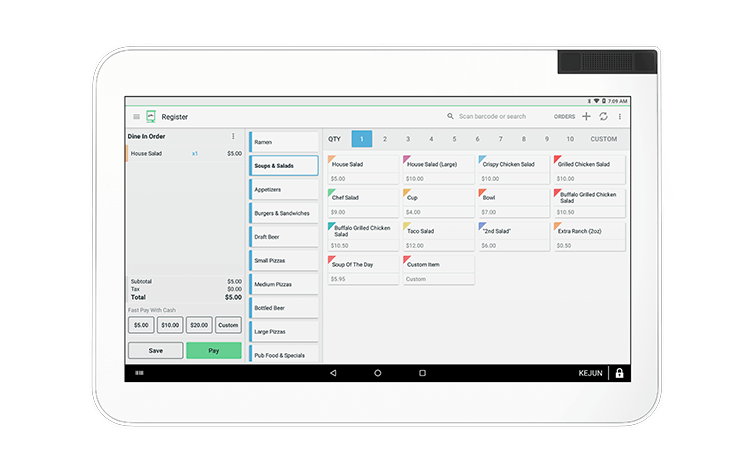

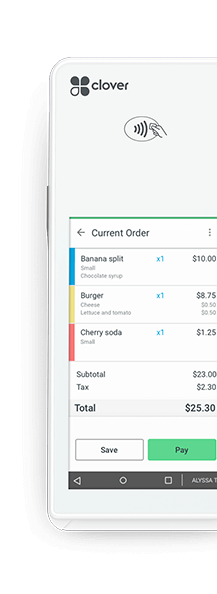

See CardHubEnabling small businesses to grow and thrive

Our all-in-one platform enables businesses to accept payments, track performance and drive sales.

See Clover

Building a smarter future

Create apps and solutions that leverage embedded fintech and payments innovations.

Visit the Developer StudioGiving back to our communities

We've committed $50 million to support Black- and minority-owned businesses.

See the impact

SAN ANTONIO

Triple Nikel

BROOKLYN

Brown Butter

BASILDON

Jemmys Catering

x

Life at Fiserv

Learn more about the culture and people behind the commerce and financial services experiences that move our world.