Driving more commerce

Carat is an omnichannel ecosystem that enables the world's best brands to drive commerce anywhere.

See Carat

Unparalleled market intelligence

A new and timely view of consumer spending activity across millions of U.S. small businesses

See Fiserv Small Business IndexEnabling small businesses to grow and thrive

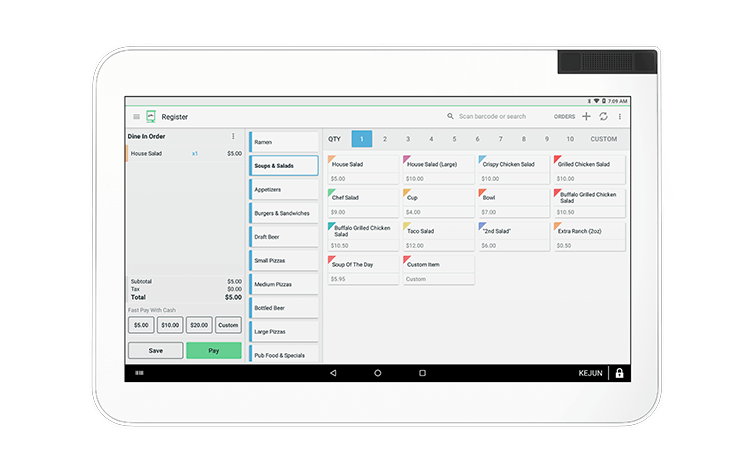

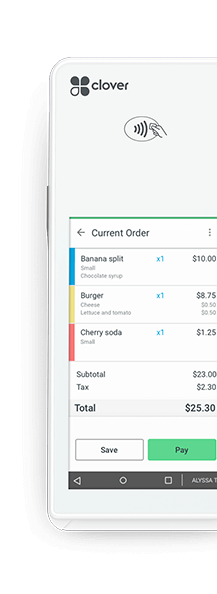

Our all-in-one platform enables businesses to accept payments, track performance and drive sales.

See Clover

Building a smarter future

Create apps and solutions that leverage embedded fintech and payments innovations.

Visit the Developer StudioGiving back to our communities

We've committed $50 million to support Black- and minority-owned businesses.

See the impact

SAN ANTONIO

Triple Nikel

BROOKLYN

Brown Butter

BASILDON

Jemmys Catering

x

Life at Fiserv

Learn more about the culture and people behind the commerce and financial services experiences that move our world.